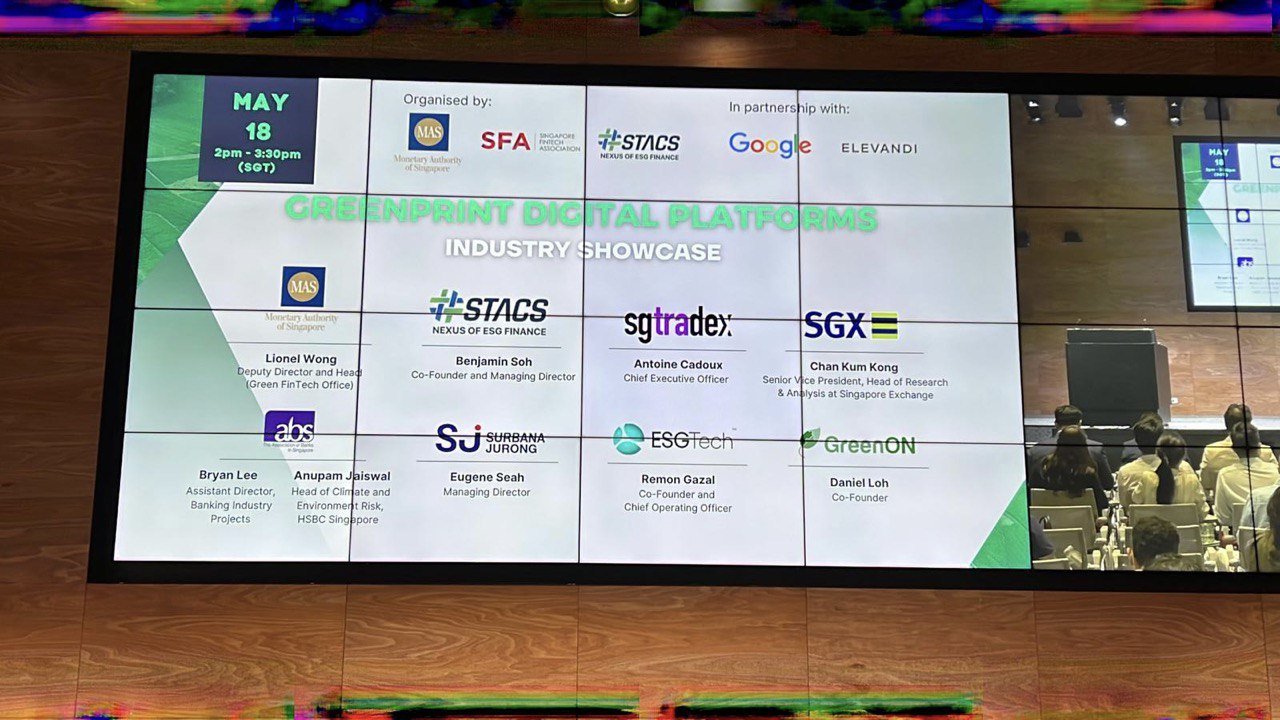

Held by the Monetary Authority of Singapore (MAS), Singapore Fintech Association (SFA), #STACS, and hosted by Google, the MAS Project Greenprint Showcase brought together firms dedicated to using technology to create a more efficient and effective ESG ecosystem. ESGTech was one of the eight platforms selected for the industry showcase.

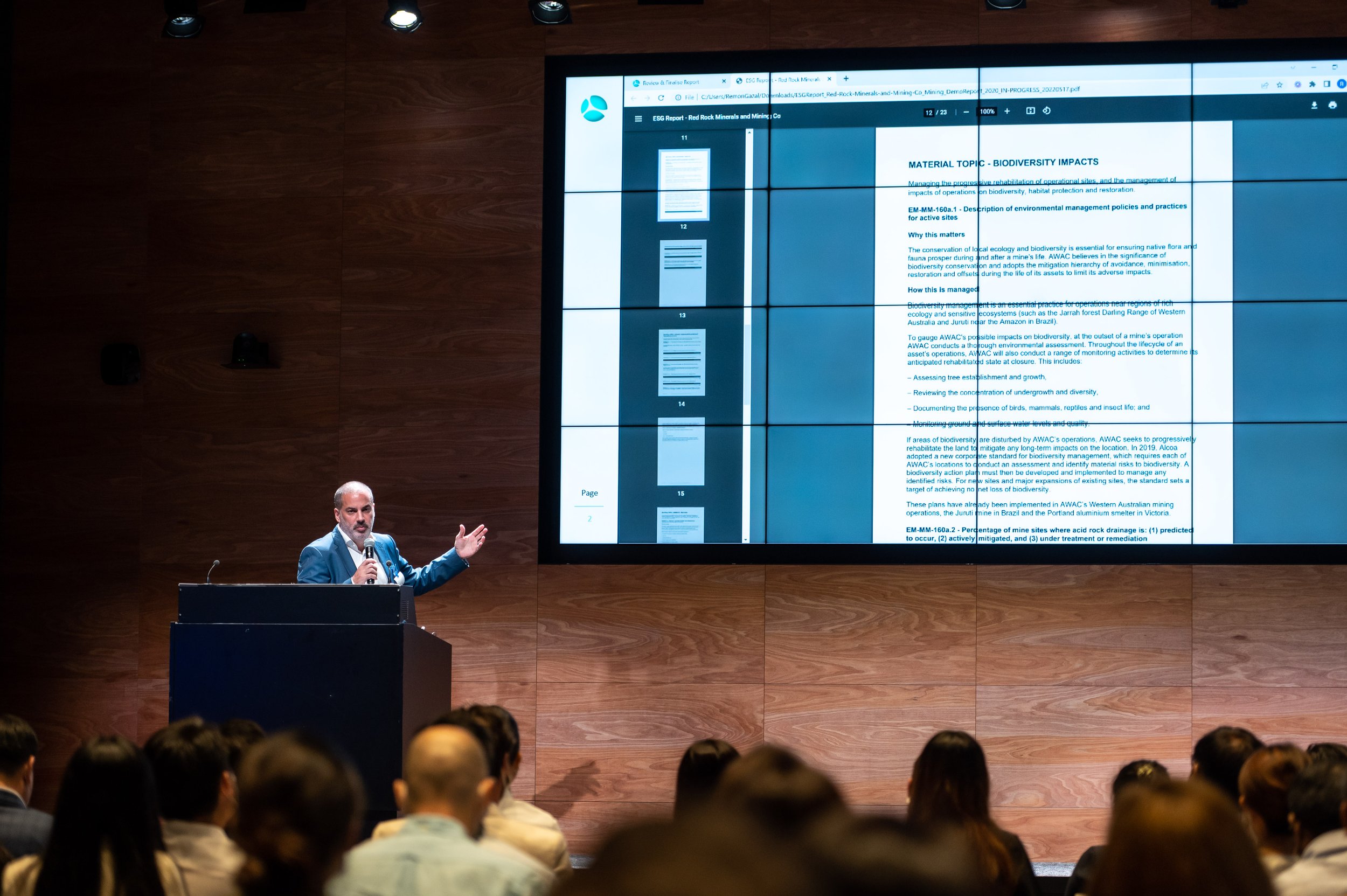

Remon Gazal, COO and Co-Founder of ESGTech presenting the disclosure report automatically generated by the ESGTech disclosure platform.

ESGTech sets a new standard for scalable and affordable ESG disclosure by empowering corporates to more seamlessly disclose ESG data, and financial institutions to easily assess the ESG risks of their loan entity.

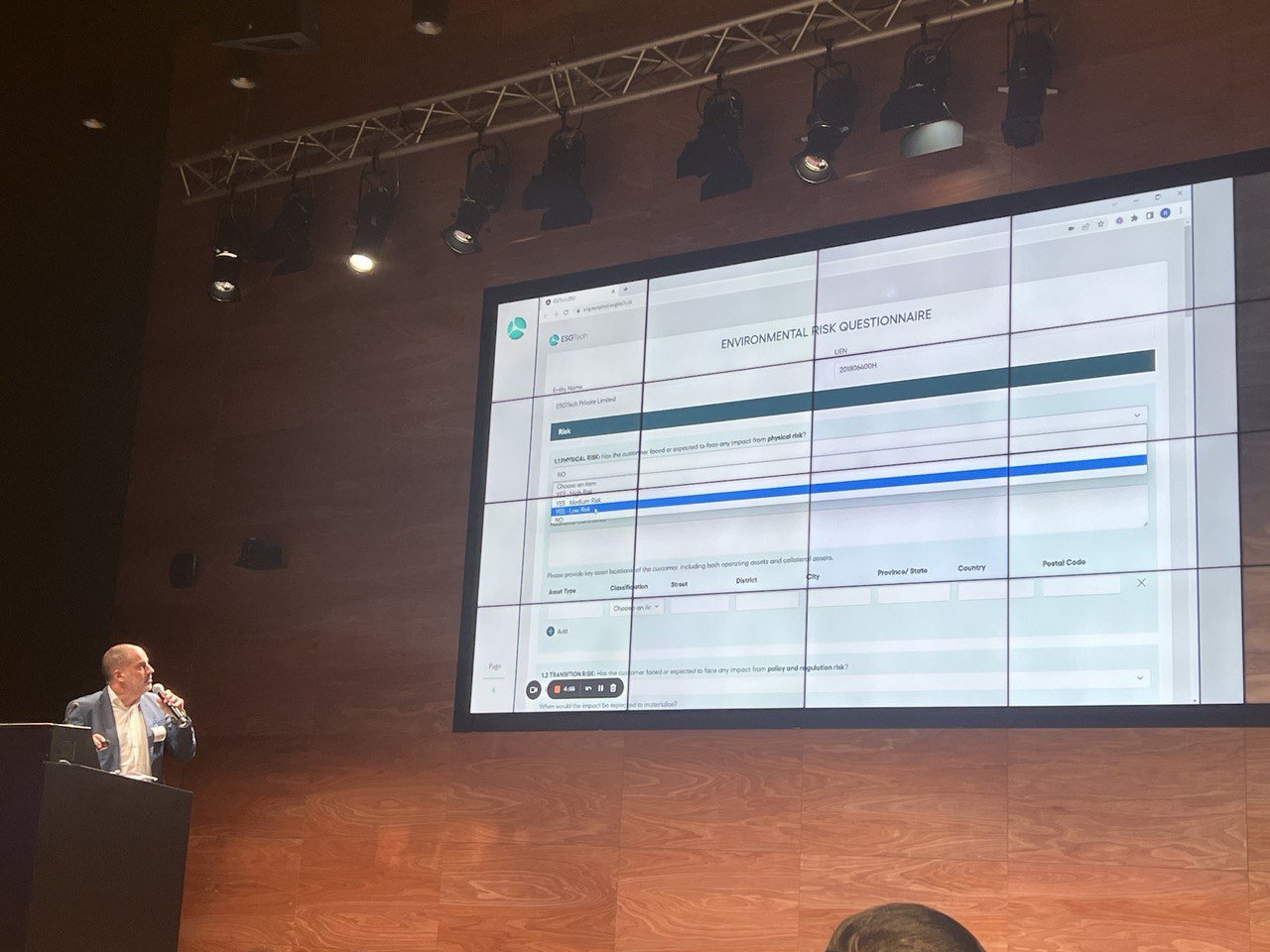

Alongside the Singapore Exchange (SGX) and the Association Banks of Singapore (ABS), ESGTech demonstrated how our tool makes it easier for corporates, banks, and asset managers to measure, track, and monitor their ESG performance. A live demonstration of both ESGTech’s disclosure platform and technology supporting the recently-launched Environmental Risk Questionnaire (ERQ) was shown to the audience, and enjoyed a warm reception.

ESG disclosure reporting has become of increasing priority as banks face mounting regulatory and stakeholder pressure to disclose their ESG performance. Amongst many other regulatory bodies, the U.S. Securities and Exchange Commission, the European Commission and the Singapore Exchange have mandated climate disclosures from publicly-listed companies. Reports of banks being raided in greenwashing claims and heightened consumer awareness means both corporates and financial institutions are being held accountable for the impact their company has on the environment and the communities around them.

During the showcase, other notable presentations includes STACS, who launched ESGpedia, the ESG Registry of Project Greenprint. It covers multiple industries and as of today, hosts 170,500 certificates, covering 61,922 companies and 112,700 assets. In another sharing, Surbana Jurong spoke of how their company strives to address major information gaps in the construction sector with their integrated platform. It aims to help users, whether businesses or financial institutions, fully understand the environmental impact of their projects.

With each sharing, speakers shared of how they sought collaborators to work with to truly advance the state of the green finance ecosystem in Singapore. Similarly, ESGTech hopes to not only improve upon our current offerings, but also work with like-minded firms to advance the green financial technology that is presently available.

About ESGTech

ESGTech’s disclosure tool helps make it easier for corporates, banks and asset managers to measure, track and monitor their ESG performance. By utilising established international frameworks that are industry-specific and investor-focused, they ensure transparent and standardized disclosure reporting so companies can focus on reporting with ease.

Schedule a demo or sign up for a 21-day free trial to find out how it works.